Outside of cheese, China is the number one importer of essentially every major dairy product. Globally, the world’s most populated country purchases 27% of all traded dairy products on a milk solids basis. China accounts for roughly 20% of all U.S. dairy exports and nearly half of all U.S. dry whey exports.

Outside of cheese, China is the number one importer of essentially every major dairy product. Globally, the world’s most populated country purchases 27% of all traded dairy products on a milk solids basis. China accounts for roughly 20% of all U.S. dairy exports and nearly half of all U.S. dry whey exports.

All of this makes China an unquestionably important market; yet, over the last year, Chinese demand has been down significantly. Chinese milk solids imports over the last 12 months are down 16%, and they’re heavily down in skim milk powder (-20%), dry whey (-17%), and whole milk powder (-24%). Two key pieces that have led to the pullback are high stockpiles and COVID-19 lockdowns.

Following the onset of the pandemic and wanting to ensure adequate supplies on hand, China built up some impressive stocks, especially in skim milk power and dry whey. From mid-2020 through mid-2021, Chinese milk solids imports climbed 32% over the preceding 12 months. For the same time period, skim milk powder and dry whey imports rose 32% and 50%, respectively.

This high purchase volume outpaced demand and led to stock build up. These high stocks, coupled with then-high global prices, led China to pull back from the global market and instead work down its stockpiles. That largely kept Chinese purchasing depressed over the past year. Encouragingly, stocks are now approaching more normal levels, which supports China returning to the market, especially for skim milk powder and dry whey.

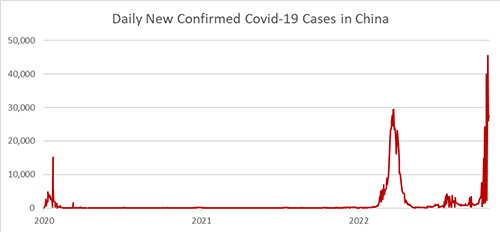

More COVID-19 lockdowns throughout China are also plaguing demand. While the rest of the world moves on from the pandemic and reverts to pre-COVID-19 life, China seems to be charging in the opposite direction. The zero-COVID policy in China has led to extreme measures in the country, with huge swaths of the population being locked down as the country continues its losing battle against the disease.

Earlier this year, Shanghai, the largest city in China with roughly 25 million residents, was put in lockdown for two consecutive months. Since then, lockdowns have only increased in number and severity, with some estimates as of late October stating there were more than 200 million people affected by lockdowns nationwide.

While many agree China relaxing its zero-COVID approach would be beneficial, rising cases in the country suggest that’s unlikely to occur. The country is facing the highest rate of new cases since the start of the pandemic, which means lockdowns and tough restrictions are only going to become more commonplace. That’s hitting dairy demand. Restaurants and the food service sector are hugely important to dairy consumption in China, but that consumption avenue is being restricted as consumers are increasingly unable to leave their homes. Until lockdowns and restrictions ease, Chinese dairy demand will continue to be challenged.

Source: USDEC, Our World in Data

Dairy is only one part of a Chinese economy that’s facing headwinds. A limited gross domestic product (GDP) growth outlook, a teetering real estate sector, and depressed, COVID-19-driven demand from lockdowns are creating a challenged economic outlook. The 2022 GDP forecast is estimated at 3.2%, which would make for one of the worst performances in nearly half a century; 2023 looks only slightly better, with forecast growth of around 4.4%.

Similarly, Chinese dairy demand in 2023 is likely to see similar sluggish growth. Despite the melancholy economic outlook and lockdown projections, Chinese imports in 2023 will likely be up, but not at substantial volumes, and certainly not same at the growth rate we saw in 2021. As stocks are depleted and domestically produced products (which are largely more expensive than imports) fail to meet demand, China will have to return to the global market. The biggest swing factor, though, remains COVID-19 lockdowns. If China doubles down on lockdowns, demand will likely continue to be depressed and imports will be challenged. Should they ease, China will certainly need product, and greater imports will follow — and that would be good news for U.S. exporters.

This column originally appeared in Hoard’s Dairyman Intel on Nov. 28, 2022.

By William Loux, Vice President, Global Economic Affairs, NMPF and U.S. Dairy Export Council.

By William Loux, Vice President, Global Economic Affairs, NMPF and U.S. Dairy Export Council. By Shawna Morris, Senior Vice President for Trade, NMPF and U.S. Dairy Export Council.

By Shawna Morris, Senior Vice President for Trade, NMPF and U.S. Dairy Export Council. Outside of cheese, China is the number one importer of essentially every major dairy product. Globally, the world’s most populated country purchases 27% of all traded dairy products on a milk solids basis. China accounts for roughly 20% of all U.S. dairy exports and nearly half of all U.S. dry whey exports.

Outside of cheese, China is the number one importer of essentially every major dairy product. Globally, the world’s most populated country purchases 27% of all traded dairy products on a milk solids basis. China accounts for roughly 20% of all U.S. dairy exports and nearly half of all U.S. dry whey exports.